The parent company of uniCredit, Hoda Holdings, has sued the Bank of Ghana (BoG) for revoking its licence.

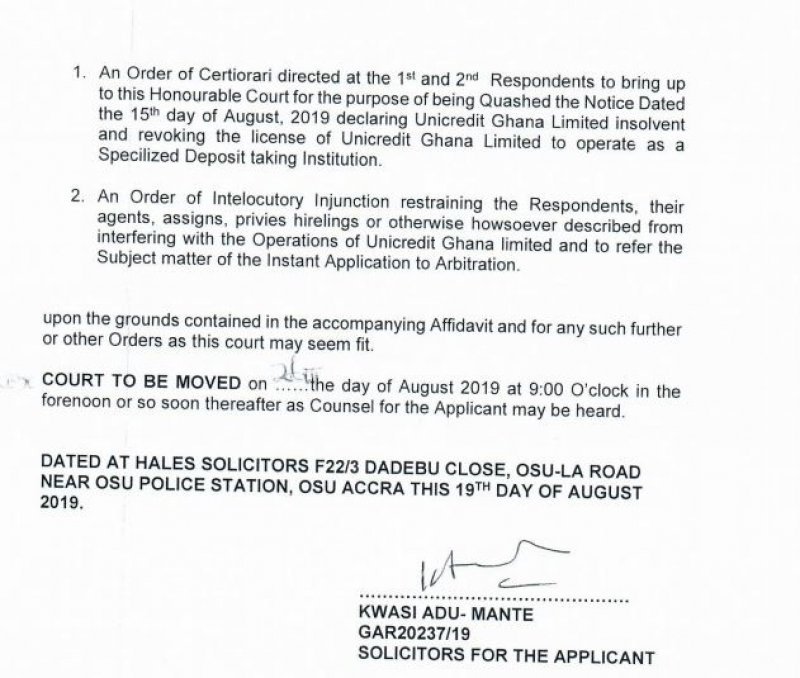

In a writ filed before the Human Rights Division of the High Court on Monday, 19 August 2019, the shareholders asked to quash the action of the central bank.

The BoG has, on Friday, 16 August 2019, revoked the licences of 23 insolvent savings and loans companies and finance houses including uniCredit.

The action of the Central Bank was pursuant to Section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a Bank or Specialised Deposit-Taking Institution (SDI) where the Bank of Ghana determines that the institution is insolvent.

The Bank of Ghana has since appointed Eric Nipah as the Receiver for the specified institutions in line with section 123 (2) of Act 930.

According to the BoG uniCredit, was overexposed to a related party, uniSecurities Limited, a sister company and its inability to access its funds from uniSecurities, even though overdue, has resulted in severe liquidity challenges and its inability to meet withdrawal requests of customers.

uniCredit Savings & Loans Ltd. was therefore found to be insolvent with a negative capital adequacy ratio and negative net worth following the Bank of Ghana’s assessment as of December 2018 hence the revocation of the license.

However, in a writ filed on Monday, 19 August 2019, Hoda Holdings Limited, the mother company of UniCredit, is seeking “an order of interlocutory injunction restraining the respondents, their agents, assigns, privies hirelings or otherwise howsoever described, from interfering with the operations of uniCredit Ghana Limited and to refer the subject matter of the instant application to arbitration.”

Facebook Twitter Google+

Naagyei 90.3 Fm Agyapa

Naagyei 90.3 Fm Agyapa